unlevered free cash flow calculator

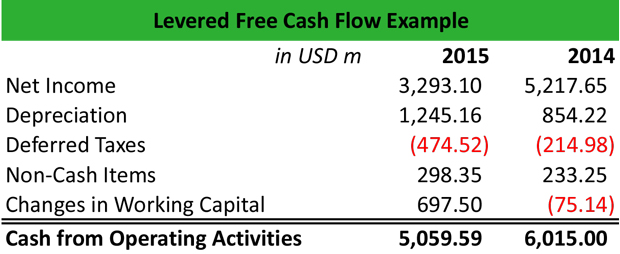

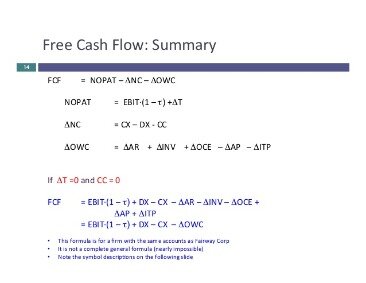

Free cash flow is calculated as EBIT or operating income 1 -. Formula and Calculation of Levered Free Cash Flow Levered Free Cash Flow LFCF Formula.

Unlevered Free Cash Flow Definition Examples Formula

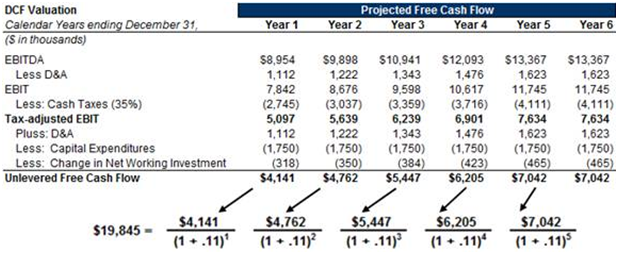

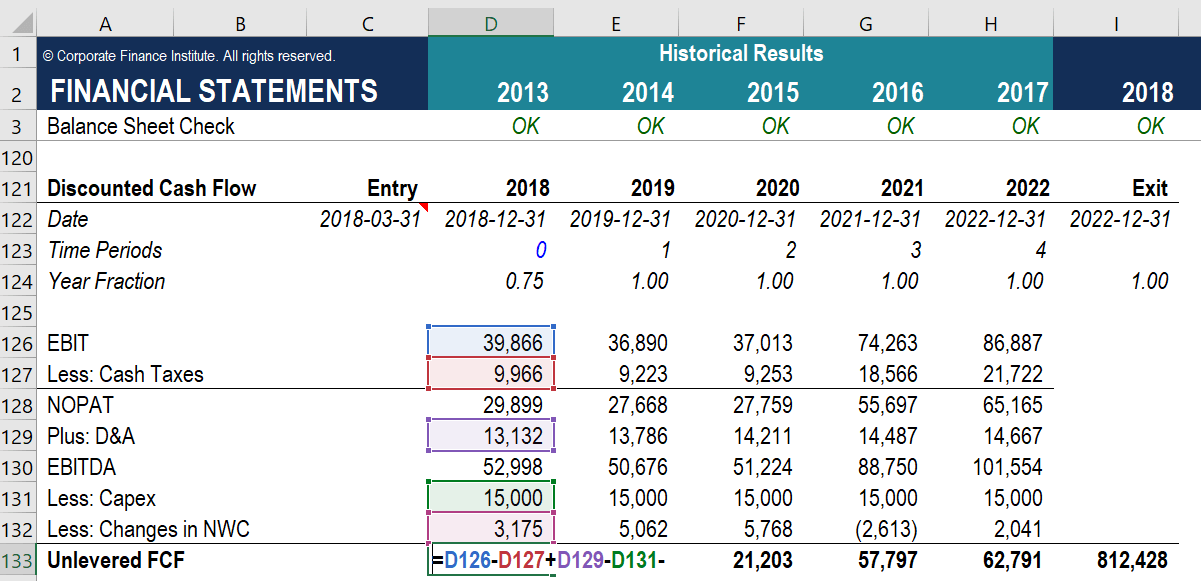

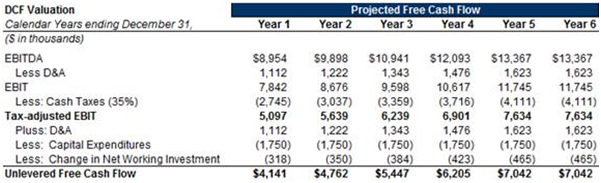

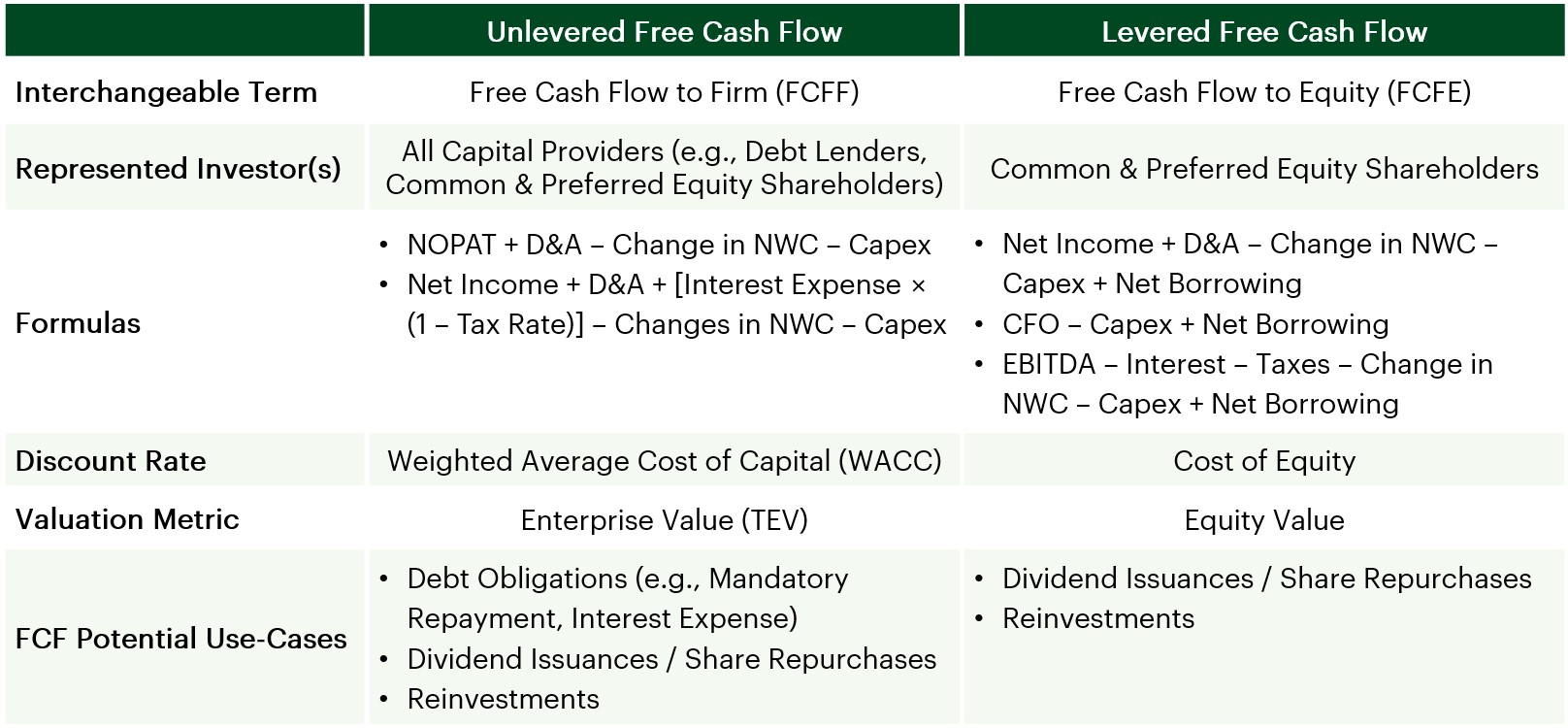

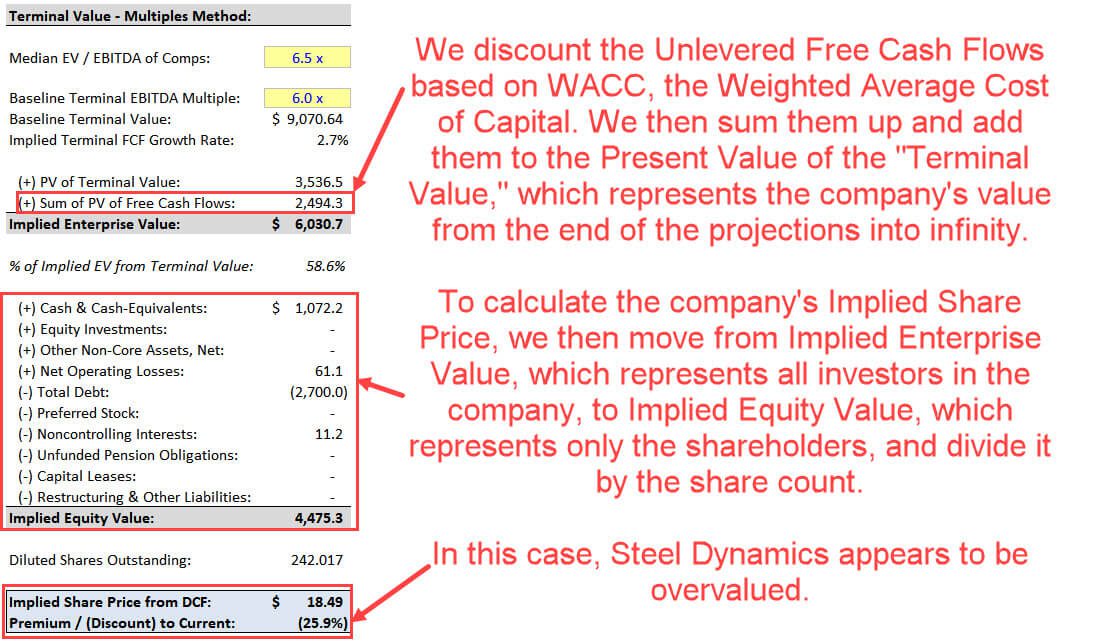

When performing a discounted cash flow with unlevered free cash flow - you will calculate the enterprise value.

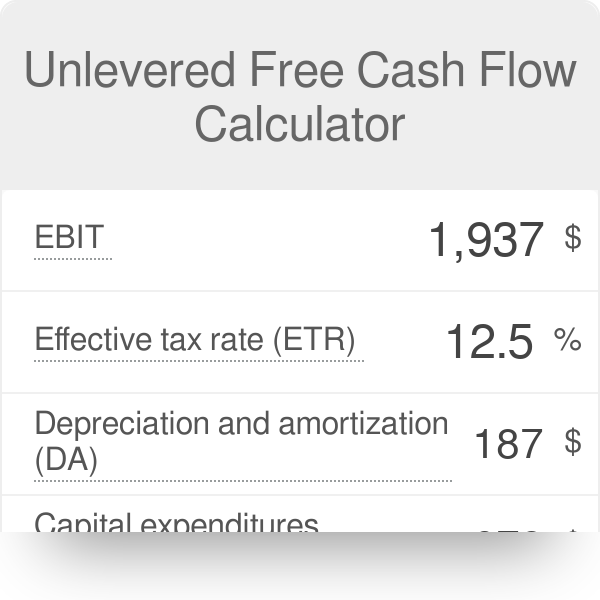

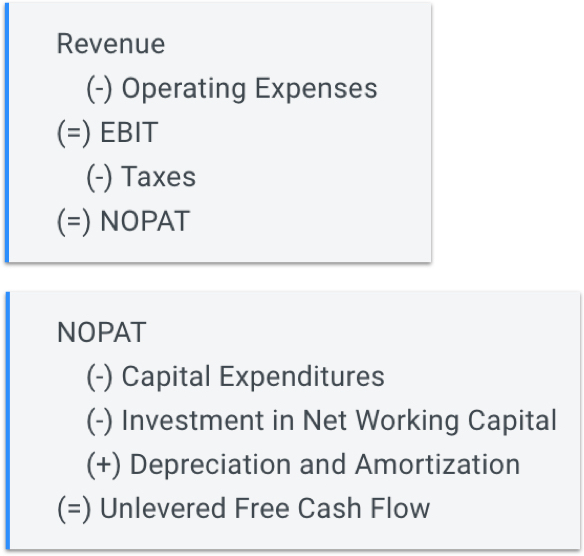

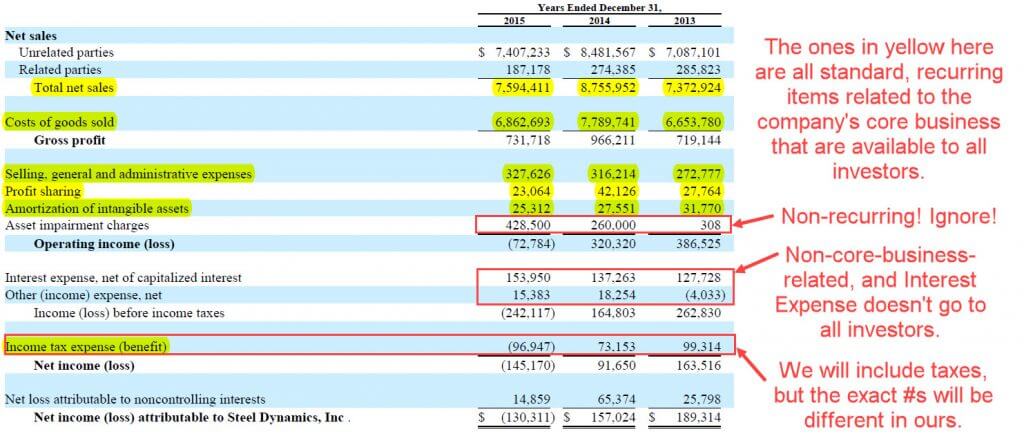

. 8 hours agoFinancial Results. To calculate Unlevered Free Cash Flow we start EBITDA less DA because its tax-deductible to get EBIT. Step 1 Cash From Operations and Net Income Cash From Operations is net income plus any non-cash expenses adjusted for changes in non-cash working capital accounts receivable.

UFCF is calculated as net income plus depreciation and. Start with Operating Income EBIT on the companys. Using simple Free Cash Flow the formula is Net Income DA NWC.

From here we add. How to Calculate Unlevered Free Cash Flow. How do you calculate unlevered free cash flow from net income.

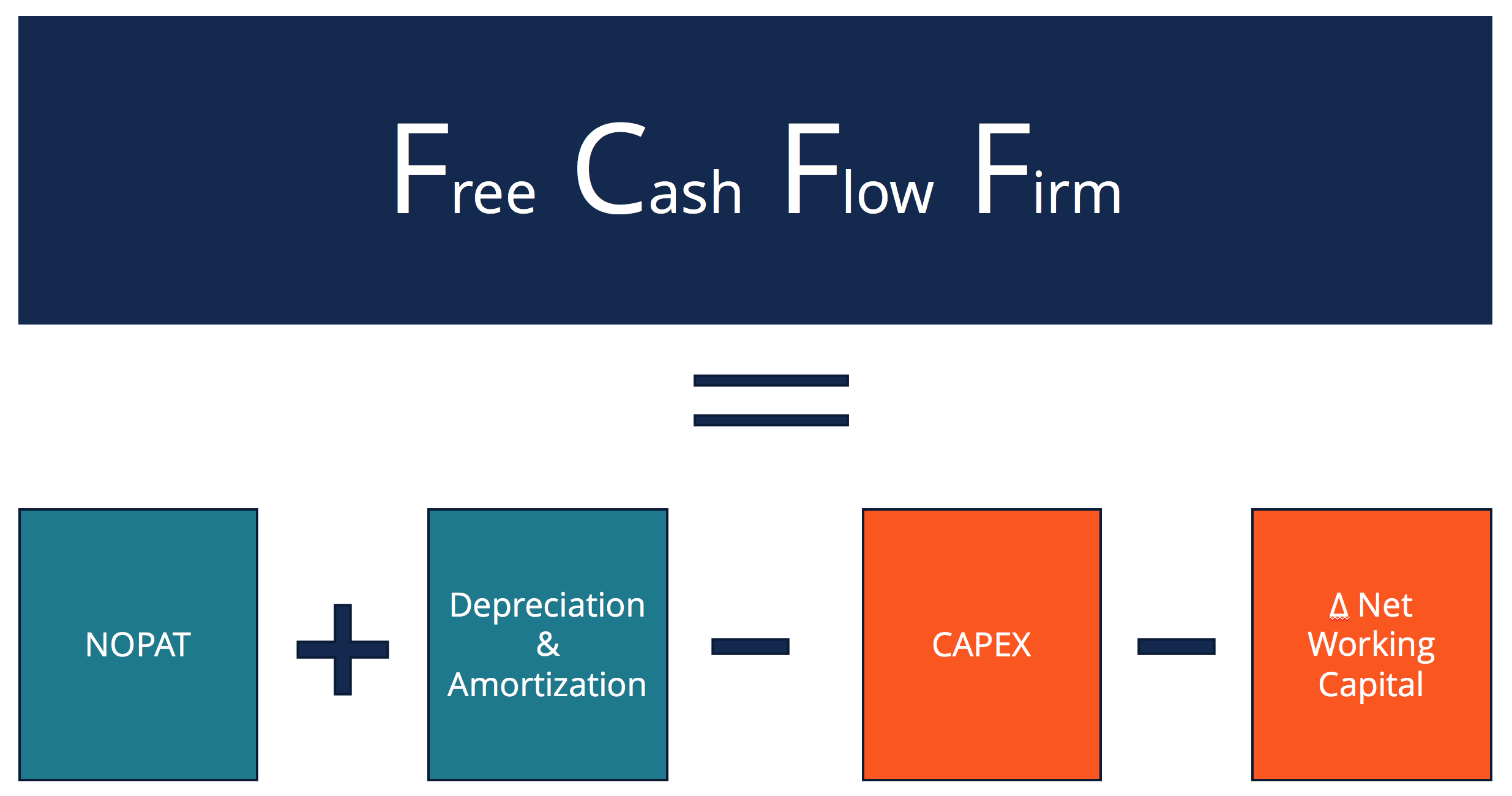

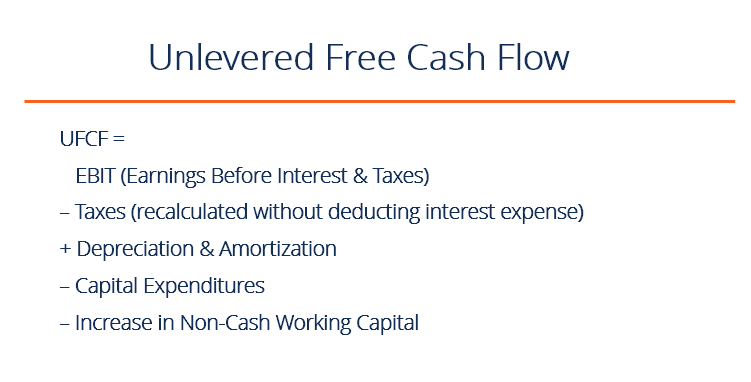

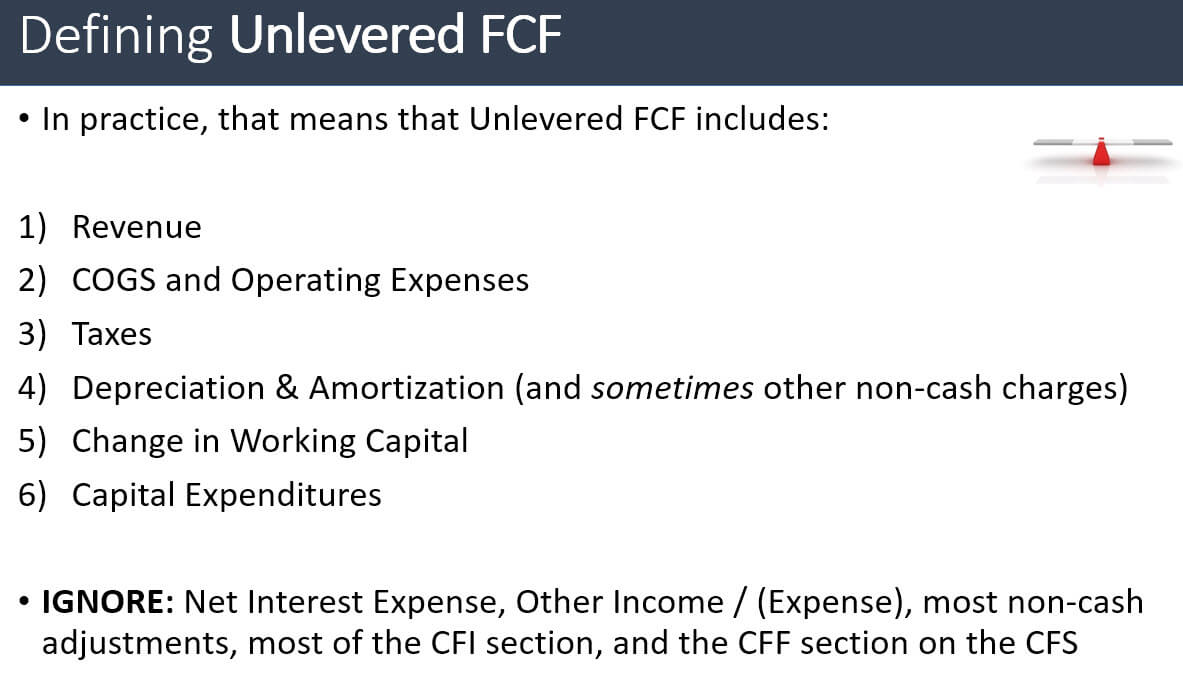

Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. The internal rate of return IRR calculation is based on projected free cash flows.

Hence Free cash flow available to the firm for the calendar year is. Before we dive in its helpful. The IRR is equal to the discount rate which leads to a zero Net Present Value NPV of those.

This figure is also referred to as operating cash Then subtract capital. As of March 31 2022. A business or asset that.

Ad Get 3 cash flow strategies to stop leaking overpaying and wasting your money. Ad Get 3 cash flow strategies to stop leaking overpaying and wasting your money. The formula to calculate unlevered free cash flow UFCF is as follows.

To calculate FCF get the value of operational cash flows from your companys financial statement. The formula to calculate the unlevered free cash flow for a company is the following. Unlevered FCF Yield Formula Unlevered FCF Yield Free Cash Flow to Firm Enterprise Value By standardizing in this way the yields can be benchmarked against comparable companies of.

Free Cash Flow 550 million 100. 93 of small business owners are constantly leaking money on useless and unnoticed things. Unlevered Free Cash Flow Formula Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this.

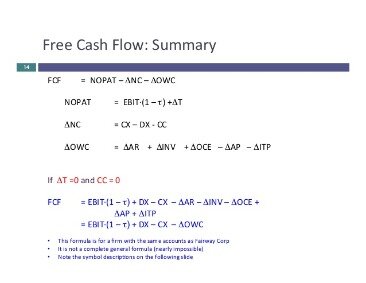

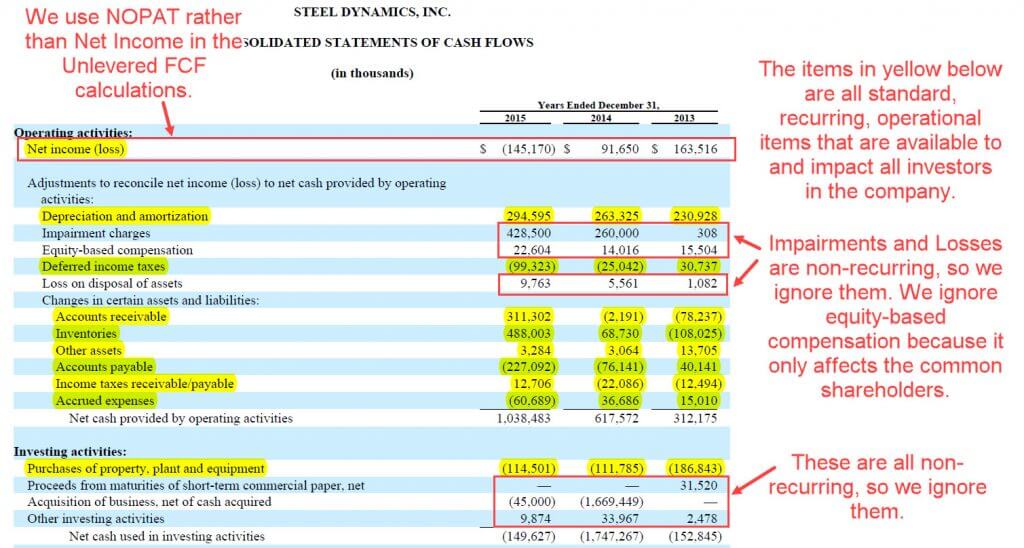

Free Cash Flow Operating Cash Flow Capital Expenditure Net Working Capital. FCFF Formula FCFF CFO Interest Expense 1 Tax Rate CapEx On the cash flow statement. Unlevered free cash flow is more involved to calculate as different items may or may not be included in the calculation depending on the company.

Below is the formula 1 of Free Cash Flow aka FCF for short FCF NET INCOME NON-CASH EXPENSES CHANGE IN NET WORKING CAPITAL CAPITAL EXPENDITURES Steps to. Unlevered Free Cash Flow. And then we tax-effect EBIT to arrive at NOPAT.

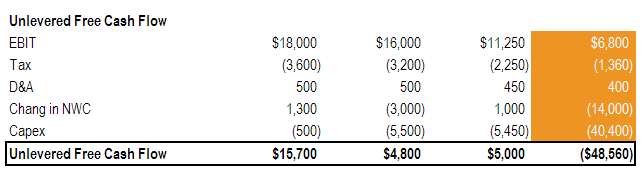

Unlevered free cash flow earnings before interest tax depreciation and amortization - capital expenditures - working capital - taxes What does unlevered mean. FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash. UFCF EBITDA - CAPEX - Working Capital - Taxes To fully understand and successfully execute the.

Using Unlevered Free Cash Flow the formula is Net Income Interest Interest tax rate DA NWC CAPEX. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. The difference between UFCF and LFCF is the financial obligations.

Used interchangeably with unlevered free cash flow the FCFF metric. Levered free cash flow on the other hand works in favor of the. Unlevered free cash flow UFCF is an important metric for assessing a companys financial health and its ability to generate cash flow.

The next formula for calculating FCFF starts off with cash flow from operations CFO. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure. Free Cash Flow excluding Special Items was 846 million in the first quarter 2022 compared to 850 million in the first quarter 2021.

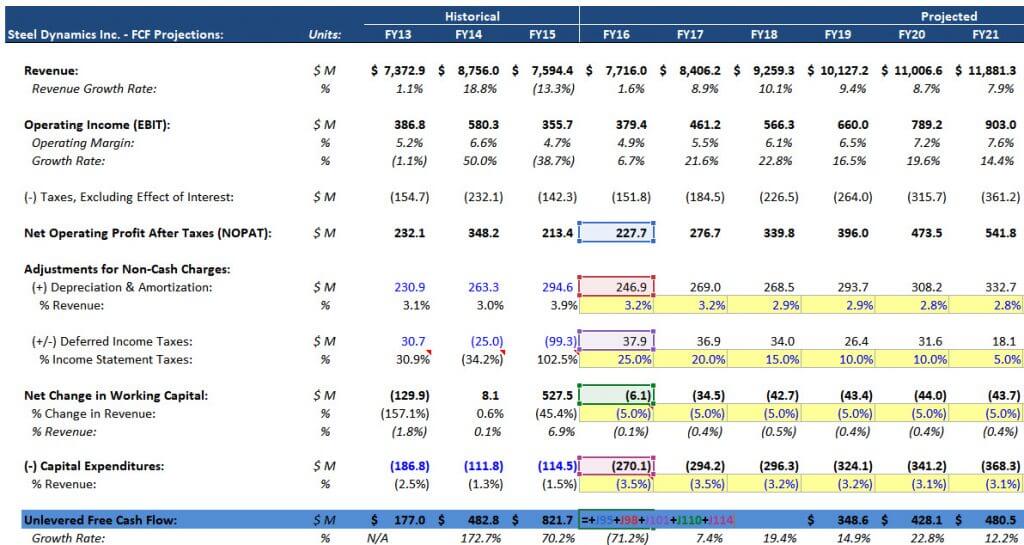

Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. Putting Together the Full Projections Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx And we. 93 of small business owners are constantly leaking money on useless and unnoticed things.

Unlevered free cash flow UFCF is cash before debt payments are made.

Free Cash Flow Shop 60 Off Espirituviajero Com

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Formulas Definition Example

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Wave Accounting

Unlevered Free Cash Flow Calculator Ufcf

Free Cash Flow Shop 60 Off Espirituviajero Com

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial